Ministry of Finance, and NRA Train NGOs and INGOs on PAYE Calculation and Finance Act Compliance

The Ministry of Planning and Economic Development (MoPED), in collaboration with the Ministry of Finance and the National Revenue Authority (NRA), conducted a capacity-building training for Country Directors, Finance Managers, and Human Resource Managers of Non-Governmental Organizations (NGOs) and International Non-Governmental Organizations (INGOs).

The training, held at the Freetown City Council Auditorium, focused on the calculation of Pay-As-You-Earn (PAYE) tax for both national and international staff, as well as providing education on the Finance Act and Duty Waiver Act to ensure compliance with national tax regulations.

Chairing the session, Eric Massally, Director of NGOs at MoPED, emphasized the importance of the training in addressing longstanding compliance challenges related to PAYE and Duty Waiver Tax. He recounted the extensive consultations undertaken between MoPED, the Ministry of Finance, and the NRA to ensure a fair and transparent tax system. Massally noted that previous engagements with NGOs and INGOs highlighted concerns about the PAYE obligations of expatriate staff. Following recommendations, the requirement for expatriates to start paying PAYE came into effect in January 2025, necessitating public education to ensure clarity and compliance. He further stressed that such engagements foster inclusivity, allowing NGOs and INGOs to contribute to policy development and national ownership of regulations.

In her welcome address, Alice Neneh James, Coordinator of the Sierra Leone Association of Non-Governmental Organizations (SLANGO), commended the NRA, MoPED, and the Ministry of Finance for their collaborative efforts in organizing this historic training. She acknowledged that the NRA’s directive for expatriate PAYE compliance was introduced in 2024, with enforcement for INGOs commencing in January 2025.

Delivering a statement on behalf of the NRA Commissioner General, James B. Tengbe, Commissioner of the Domestic Tax Department, expressed appreciation for the vital contributions of NGOs and INGOs in sectors such as health, education, governance, and humanitarian response. He highlighted the importance of compliance and collaboration, assuring participants that the NRA is committed to supporting NGOs in understanding their tax obligations while considering their operational concerns.

Tengbe addressed key tax issues, including the misconception that institutional exemptions apply to employment income, clarifying that residents remain subject to personal income tax. He also noted the requirement for NGOs to deduct and remit withholding taxes when engaging vendors or contractors, as well as the obligation to comply with Goods and Services Tax (GST/VAT) in specific procurement transactions. He introduced the Integrated Tax Administration System (ITAS), a digital platform aimed at simplifying tax registration, return filing, payment tracking, and issuance of Tax Clearance Certificates.

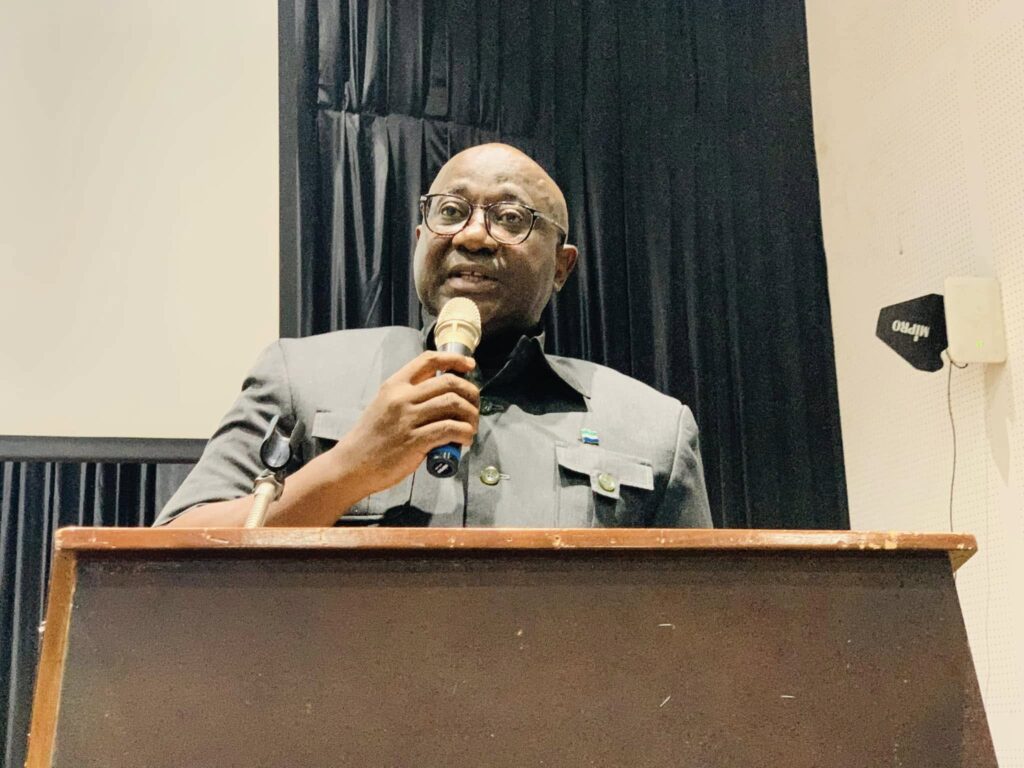

In his address, Acting Minister of Finance, Hon. Bockarie Kalokoh, reaffirmed the government’s commitment to balancing tax exemptions with the need to mobilize domestic revenue for national development. He acknowledged that unregulated tax exemptions have contributed to revenue shortfalls, emphasizing the importance of the Tax and Duty Exemption Act 2023 in streamlining processes and blocking leakages.

The Minister explained that the Tax and Duty Exemption Act 2023 introduces a simplified and transparent exemption application process to minimize delays. The Act expands exemptions for NGO-imported vehicles to support operations and mandates that all NGOs submit their import requirements to relevant supervisory ministries for accountability and transparency. He emphasized that the government remains committed to working in partnership with NGOs to achieve national development goals. He noted that the Act serves as a testament to the government’s dedication to creating an enabling environment for NGOs to thrive.

In his keynote speech, Deputy Minister of Planning and Economic Development, Rev. Dr. Jonathan Titus Williams, commended NGOs for their role in education, healthcare, poverty reduction, and humanitarian efforts. He stressed that tax compliance is crucial for transparency, accountability, and effective resource management. He encouraged NGOs and INGOs to adhere strictly to PAYE calculation guidelines to avoid penalties, stay informed about Finance Act amendments to maintain compliance, and utilize duty waivers responsibly to prevent misuse and maintain government support.

He reiterated that this training marks a significant step toward fostering compliance and efficiency in financial management within NGOs and urged participants to actively engage, seek clarifications, and implement best practices in tax compliance and financial accountability. He assured stakeholders of the government’s continued support in ensuring an enabling environment for NGOs to operate effectively.

Samuel Fullah, Commissioner of Domestic Tax, presented an overview of the Finance Act and PAYE, underscoring the importance of proper registration and accurate tax filings. He emphasized the role of financial records in ensuring transparency and accountability and highlighted compliance penalties and interest for tax violations. He further elaborated on the nature of tax payments, including obligations for non-resident contractors, resident contractors, non-resident employees, rental tax, professional fees, end-of-service benefits, and management fees. He explained the procedures for PAYE and compliance requirements under the Finance Act.

The Director of Revenue and Tax Policy provided a detailed explanation of the Tax and Duty Exemption Act 2023, outlining categories of goods and services eligible for exemptions, including items imported by embassies and international missions. He noted that exemptions also cover goods brought in for public health emergencies, education, and humanitarian aid that directly benefit Sierra Leoneans.

During the interactive session, Country Directors of NGOs and INGOs raised concerns about certain tax provisions. Government officials assured them that these issues would be reviewed in the next revision of the Finance Act. The training concluded with a call for continued collaboration between the government, NGOs, and INGOs to foster transparency, compliance, and sustainable development in Sierra Leone.

For more information, please contact Alfred Kabia at +23279174027 or visit MoPED’s social media platforms: Twitter (@moped2025), Facebook, or the official website (moped.gov.sl).